What is a budget?

A budget is an estimate of revenue and expenses over a specified future period of time. There are different types of budgets – those for a person, a family, a business, and even a country.

What is budgeting?

Budgeting is the process of –

- making a list of all income and estimating expenses,

- planning and analyzing this list, which allows us to

- make decisions about expenses and saving.

For corporations and countries, budgets are an essential part of running any business efficiently and effectively.

Sounds complicated! Why would I need a budget?

Creating and using a budget helps you closely monitor your income or cash flow (or even pocket money or allowance) from month to month to see how much money you make, spend and save.

Monthly budgeting

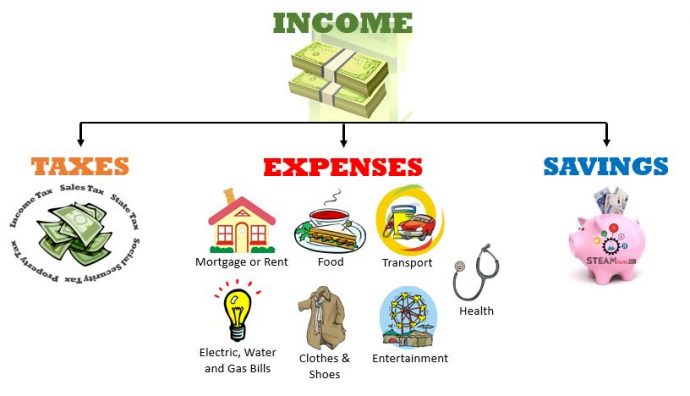

Income – this how much money you receive monthly. This could be your salary from your job, allowance, pocket money, interest from savings accounts, or monthly income from investments.

Taxes – Once you deduct all taxes (income tax, state tax, social security tax, any property taxes) from your income, what we have left is called net income.

Expenses – these are a wide variety of things that we spend money on. These can be classified as needs (housing mortgage/rent, food/groceries, transport, electric, water and gas bills, and health expenses) vs. wants (clothes and shoes can be both need or want; entertainment can include travel, movies, eating out, sports, etc.)

Savings – at the most basic, this is the money left over after you deduct expenses from net income. However, as you start to get more stable and efficient at managing your finances, make savings a priority as soon as you receive your paycheck, and start putting away a good chunk of your net income into savings.

Okay, how do I get started?

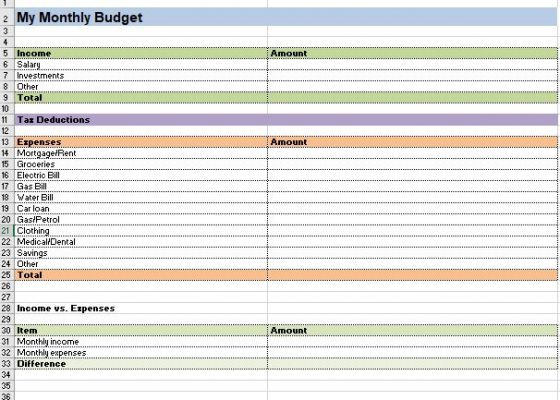

Budgeting can be as simple as making regular notes in a notebook. However, we highly recommend using an Excel spreadsheet (see example to the right) to track your monthly budget. As you grow more efficient at budgeting, you’ll find computer software, cloud-based software or even smartphone apps that help you manage your finances effectively and efficiently.

- How To Write A Lab Report - April 8, 2023

- The States (Phases) of Matter - June 9, 2020

- What is Engineering? - June 2, 2020